We all know that the easiest way to pocket money in the finance industry is to tell your customers/clients exactly what they want to hear, depending upon what you’re selling, which is always that the assets they hold are going to skyrocket in price, as by nature, people’s strong confirmation bias tendencies make them gravitate towards positive assessments of the assets they hold and to dismiss the negative sentiments of the assets they hold. This is a tested and true formula. What is the most difficult character trait to display in this field is honesty, which consists of always dispensing one’s honest opinions, even if it is not what the clients want to hear. Thus, all honest bitcoin analysts in November 2021 informed their clients that Bitcoin was going to crash because the signs were so clear that this was going to happen that not only did I warn of this event once both on my Patreon platform and here, but I issued multiple warnings for BTC holders to sell ALL of their BTC back then. And then BTC crashed from $70k to less than $16k in just a few months. Likewise, though not as big a crash, I stated earlier this week the following:

“With gold/silver markets closed for the entirety of Chinese New Years this week, I expect gold/silver prices to be pushed lower this week from their respective prices of $2027 and $22.64 by the Western MIB complex.”

Though I don’t believe I provided exact bottom price targets here, I provided levels for the price pullbacks on my patreon platform, on which I provide daily analysis of gold and silver four times a week, every week (recall this platform is for my macro analysis and some stock picks and my patreon platform is for more day to day analysis, or micro analysis, both of which are vital for proper investment decisions). During the prior week of 5 February to 9 February, when gold was trading close to $2,040 and silver was close to $23, I stated a belief to my patrons that the Western banking cartel was going to use the week long Chinese New Year holiday to slam gold back down to below the $2,000 mark and silver to below $22.

In fact my belief was so strong on the basis of research I conducted two weeks ago , that I informed my patrons interested in options trading strategies the necessity of closing an options trading strategy I had opened just a few days prior. I believed two weeks ago that a much better entry point was going to materialize for these call options in all likelihood this past week. And thus, I advocated closing out call options positions two weeks ago in silver assets at a slight profit or break even levels to reposition them for this past week. And that turned out to be the exact correct strategy as my predictions could only be optimized by investors willing to accept the bad news I told them, but bad news that would offer far better opportunities to go long with derivatives products like options.

In other words, the majority of holders of BTC and gold never want to hear that the asset they hold is going to crash temporarily and to sell to avoid a big crash and they would much rather hear nonsense from perma bulls that their assets are always going to rise in price even when clearly, as was the case way back in November 2021, there was a far better chance of BTC temporarily crashing mightily than rising. In fact I informed my patrons opinions about gold and silver asset prices this past week that essentially were the same as opinions I dispensed about BTC in November 2021 - that there was a far better chance that being long would work out by temporarily exiting and then re-entering the market after a significant price dump occured. In both instances, the predicted scenario with the best probability of manifesting unveiled itself, at which point I then relayed my strategy to go long. And as you can see below now, with the use of basic proper exit strategies, if gold and silver prices get pushed back down next week, I will exit all my positions at profits and if they continue to move higher I will exit at much higher profits. In other words, I put my money where my mouth was regarding my own analysis and went long in many gold/silver assets once my predicted price dump occurred early last week.

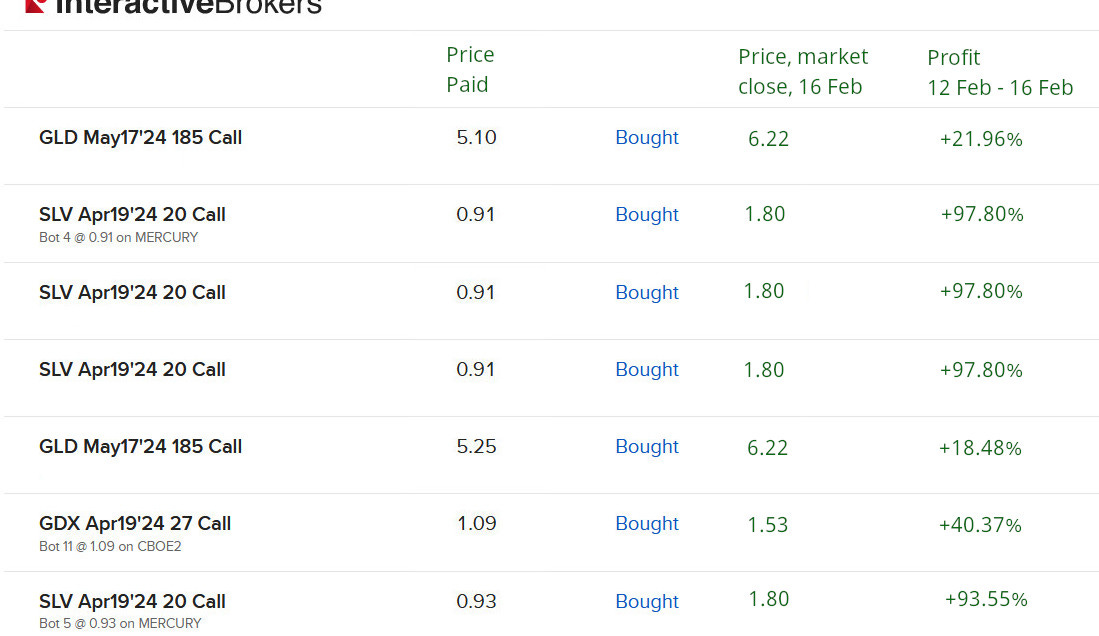

My options trades executed this past week based upon my own analysis provided here and on patreon

Furthermore, the above positions are only a partial list of the positions I opened on the significant gold and silver price dump, as I also opened some call options on some gold and silver mining stocks as well. Since I don’t disclose the exact amount of my positions as doing so allows investment firms that specifically tried to bankrupt me in the past to specifically target my positions for retribution, due to the nature of the topics about which I speak that they desire to remain unspoken, I removed the exact number of calls I opened for most of the above positions. However, in order for everyone to understand the confidence I possess in my own analysis, which is a very important aspect that I believe every analyst should demonstrate, I left enough raw data above for my purchased GDX options and some purchased SLV options to understand that I bought a minimum of $1k to an undisclosed amount of thousands of dollars in each option position I opened this past week.

In any event, in a derivative investment product that received loads of attention during lockdowns, as bored retail traders ramped up their options strategies, only to be fleeced by the investment industry of more than a billion dollars during lockdowns, to open a position in a product that causes so many losses among retail investors requires a high level of belief in the quality of one’s own analysis. Otherwise, since the odds are firmly with the house (investment firms) and against the trader regarding turning profits from options trading, one will always be best served by abstaining from any options trading unless one is supremely confident in the analysis backing discussed options strategies. (Source: Bloomberg, “How Retail Options Traders Lost $1 Billion During the Pandemic.” 8 July 2022.)

In any event, with some of my silver option calls nearly at a double, just a few days after opening them, with proper exit strategies, I should be able to reap realized profits of at least 50% or 60% profit given that I act on the courage of my convictions. But that said, I better have done the legwork and research to possess the conviction I possess. A lot of analysts exhibit conviction that is based upon arrogance and not real research, and their conviction leads to huge losses on their proposed strategies. And this is a lot more than can be said with the bulk of mutual fund managers in the industry today that are happy to allocate billions of dollars of other people’s money to their stock picks but refuse to even allocate $1 to their own picks. In other words, were they convicted in their own picks, they would have no problems allocating their own savings to them, but much more often than not, they do not.

The Time Honored Financial Industry Tradition of Telling People What They Want to Hear

An investment analyst worthy of your time will always tell you his or her best researched opinions about the most probable outcomes for asset prices that should yield a solid track record over time, and never just what you want to hear. Had I started a substack newsletter called, “All the Reasons Bitcoin Will Go to a Million Dollars” at the same time I started this one, I have zero doubt because tens of thousands of BTC investors exist that are thirsty for this narrative, that my monthly revenues would be a 10X multiple of what they’ve been from this newsletter, in which I remain committed to always telling the truth about my financial opinions. However, in being a BTC analyst that wants to grow his or her fees, it literally is impossible to tell the truth, because the only circumstance that would grow such a newsletter to tens, or perhaps hundreds of thousands of clients, is an assumed deliberate strategy of forwarding reasons why BTC prices will forever move higher, 24/7 without a single injected dose of reality (I’ll provide my BTC price outlook for the remainder of this month below).

As well, if I partook or partake in this same duplicitous strategy in my analysis of gold and silver assets, it would likely create much faster growth than always forwarding my real opinions that originate from loads of time-consuming meticulous research, as doing so often involves informing people of things they do not want to hear at the moment. And as all long time followers of mine know here, when gold and silver asset prices have had great runs and peaked in the past, I always will relay this opinion, even though the dispensation of propaganda of continuing much higher gold and silver prices would put far more money in my pocket.

Thus, a simple way to eliminate the most fraudulent of analysts,

which is the vast majority of analysts in this field, is to dismiss those that are asset permabulls or asset permabears, as this is an impossible stance to take with highly price volatile assets that historically have always exhibited a lot of price volatility both to the upside and downside. Thus for someone to be a permabull in precious metals and/or bitcoin exposes such a person as taking a stance for personal enrichment reasons and not to provide the best, most honest analysis possible. And just for the newbies here, there have been several times I issued a buy opinion on BTC after predicting BTC crashes.

For example, in July 2021, when BTC crashed to $30k, I issued a buy opinion for BTC before issuing a sell everything opinion in November 2021. And if you want to know my opinion about BTC right now, I’ll provide that below as well, so keep reading. However, since it is a provable fact that no asset price rises higher without major corrections and no asset heads straight down in price unless perhaps, the CEO of a company has been endlessly lying to the media about the ongoing financial viability and sustainability of his firm, as happened with both Lehman Brothers and Bear Stearns during the 2008 global financial crisis, from a purely rational and intellectual perspective, somebody that remains committed to a unidirectional price outlook about a very price volatile asset should never be trusted.

The Most Problematic Commitment Issues with Investors

All commitment issues with investors originate from following the wrong analysts. Many investors make the mistake of ditching assets they should hold given wild price volatility swings to the downside because the analysts they follow never explain the origins of the downside price swing other than a useless “all asset prices take a breather after a large run to the upside” explanation. Knowing whether to keep holding or to ditch an asset requires a much more intellectual explanation than this as well as proper guidance from a competent analyst. Incorrect commitment issues that plague investors consist of two scenarios: Holding on to assets they should sell during big price rises, and selling assets they should hold during big price dumps. But making the proper commitment on whether to ditch an asset on a price pullback or remain vested, or whether to dump or keep holding an asset after a big price rise can often yield a very confusing decision due to muddied analytical waters provided by poor analysts. A good analyst however, will make muddy waters clear about such decisions. Furthermore, this doesn't mean an analyst will be correct 100% of the time with the provision of a well researched and thought out strategy. But at a minimum, the explanation should clarify the outlook far better than a simplistic explanation every other analyst also provides (like predicted asset price rises based upon a 20% capture of market cap of all investable assets) better reserved as an explanation by a teenager with no investment experience. Lastly, even with the provision of far superior explanations of strategies than most, that analyst`s long term track record should yield far more wins than losses.

As many of you know, I reside in Asia. Consequently, I usually try to be in bed by 10PM (a mere 30 minutes after New York markets open). This schedule enables me to obtain a solid 7 hours of sleep a night as I usually rise by 5AM every day. Thus, I fully expect experienced traders on my patron platform that followed my options strategies to have better profits from this past week than even the ones I posted above, as I only have a thirty minute window to execute my trades whereby others that live in the Western hemisphere can be more patient and execute buys at better prices. As such, all should experienced investors should have been able to purchase even the stocks I advocated yesterday at slightly better prices than my designated market open prices yesterday, as it was quite clear that the prices of all three stocks opened the day on a downtrend at market open, before reversing and ending yesterday’s session higher. Of course, I’m not dumb and I do not leave my established positions open to a potential 40% loss by the time I arise the next day, if my price predictions do not pan out as predicted. Thus, I usually commit a taboo sin in options trading, which is to put a day sell limit order on my call options positions to ensure that while I’m asleep, the worst outcome I can experience is to exit break even or end up with a minimal loss.

I label this behavior as taboo for all options traders under normal circumstances because it exposes open options positions to criminal HFT algorithms deployed by large commercial financial institutions that “hunt” automated sell orders on options (and stock) positions to force an executed sell. However, once the option prices move far enough away from one’s buy price and yields paper profits like 80% or 90%, then using sell limit orders becomes a much more tenable strategy for those that can’t watch the market all day. Algorithmic HFT software, while it can force a drop of 20% to 30% in option prices, cannot create an 80% drop in options prices in a single trading session under normal circumstances. In any event, I only use such strategies out of necessity. If I were still living in Mexico at the moment, and my daytime was also daytime in New York, I would never employ such a strategy.

Nevertheless, to solidify my point, let me relay an anecdotal story. Two weeks ago, many of my Asian friends, knowing I am a gold analyst, asked if they should buy gold prior to Chinese New Year, as many Asians are always seeking to buy more physical gold from the numerous stores that sell gold in virtually every Asian nation (a fact that may be shocking to Americans and other Westerners as gold dealers are still scarce even with the addition of big box retailers like Costco recently adding gold bars to their product base). I told them the exact same thing I relayed above and that I relayed to my patrons last week. I mentioned my belief that gold would be hit hard this past week and that, despite the fact that I could not guarantee I would be correct, I strongly believed it would be better to wait for lower prices to materialize this past week. After encountering a few of them at the end of this past week, I expected them to thank me for saving them $40 an ounce on their purchases of gold. Instead, I surprisingly learned that all had ignored my guidance and completed their purchases two weeks ago.

When I asked them why, they said that everything they read in the mass media convinced them that gold prices would keep rising this past week due to the heavy expected physical gold buying during Chinese New Years. Since this narrative made sense from a cursory perspective, they ignored my guidance and embraced the narrative espoused in the mass media. And this is a perfect example of acting on what you want to hear (buy and price goes up) versus understanding the reality of the more likely scenario (the one of gold dropping below $2,000 and silver dropping below $22 that I had told them). This is also an example of the massive lack of applicable real knowledge in the financial industry in this world, due to all the propaganda and lies spread about finance in university classrooms around the world. It is also the reason I always state that “the knowledge is power” saying is a lie. It doesn’t matter if someone gives you knowledge that will benefit you if you don’t have the capacity to understand you should heed it instead of ignore it. In this case, knowledge offered zero power to them. By the way, since I am working 15 hour days, every day, to launch my Academy very soon, including even on Saturdays, check out the new, updated fact sheet about my Academy I’ve uploaded here.

Even in Asia, because true knowledge about the price mechanisms that move the price of gold is often lacking in the knowledge base of investors, investors fail to commit to right decisions about buying physical gold (and gold mining stocks) because they are too easily influenced by the false narratives propagated in the media and by analysts that receive large media exposure that are incorrect nearly 100% of the time. The mass media in Asia heavily propagated the story of “buy now before it’s too late (propagandized FOMO or Fear Of Missing Out)” in the week prior to Chinese New Years, given explanations I’ve discussed above. But unfortunately, surface basis financial analysis, or analysis that is produced to convince investors that “what they see is what they will get” hardly ever comes to fruition. Instead, one should always commit to investment decisions not by what sounds reasonable on the surface, but on the basis of what is most likely to happen.

And this requires true understanding of an asset class unspoiled by mass media narratives of “popular” analysts and real accompanying education to correctly execute this decision making paradigm. The reality of the situation is that gold and silver prices right now are still not moved significantly by heavy Asian physical buying but by behind-the-scenes manipulation executed by Central Bankers. Just so you understand the context within which my friends made their decisions, I explained the above fact to my inquiring friends but they were too brainwashed by their MBAs to understand this truth, and thus, remained committed to the false Asian media propaganda about gold prices continuing to move higher from $2,030 and $2,040 this week (Apologies to any of my friends if you are reading this article for putting your brainwashed mindset on full blast here but doing so is solely for the benefit of all my subscribers!)

Unfortunately, it is quite natural for the majority of us, in our investment decisions, to embrace the exact wrong beliefs that will serve us best as investors. And since I have always been very transparent about my honest beliefs about asset price behavior, and have always stated when I think asset prices will go down as well as up, hopefully this makes my recent analysis about the future direction of gold/silver mining stock prices, asset prices that have been pushed down significantly to start this year, even more valuable. Though I could have executed the exact same strategies with mining stocks, I often deploy different strategies between stocks and derivative option products because of past history that informs me, most investors do NOT want to put in a lot of work for profits. For example, in one year in which I returned 69% yields from all my trades in a 12-month period, I actually lost customers because they told me the work I required was too much for them, even though these customers that left had admitted never experiencing such a high 12-month yield in their entire investment career.

Thus, when it comes to PM mining stocks, if my analysis informs me that patience can still produce high yields in the end, I will not provide guidance to trade in and out of certain stocks multiple times within a short time frame of a few months as I would with derivative products, due to the much more specialty nature and more price volatile nature of options trading. Not many investors engage in options trading as numerous studies reveal massive losses suffered by retail traders engaging in options trading in recent years. That said, quickly exiting call options trades is 100% necessary with this type of investment if one spots a potential significant temporary price suppression event due to the quick paper losses that will pile up without acting quickly. With stocks that exhibit far less daily price volatility, as events like a single trading session 40% loss, commonly experienced among option prices is rarely exhibited with stock prices, exhibiting patience as a strategy can still be executed as an intelligent strategy. Thus, if the probability of negative price volatility in stocks can be overcome with adequate patience, I tend to advocate the patience method with temporary negative price volatile periods suffered with stocks, and this strategy cannot be ultimately judged until we know whether or not the strategy of patience paid off or not.

In addition, we ultimately can judge such a strategy within a 12-month time frame and judging a patience philosophy does not rely on the disingenuous trick often used by BTC analysts to defend their strategies of predicting a $500,000 price point within a five-year time frame that they persistently defend by stating that five years have not passed. No matter the price point of BTC, even if its price is $50,000 within 12-months of their predicted deadline, they never cease providing the excuse that five years have not yet passed so their prediction shall not be judged. And often, BTC price analysts kick their price predictions two or five years further down the road when it becomes clear their original price predictions will not come true, and “update” their prediction to a 7 or 10-year price prediction, all the while sticking to their prediction being a 5-year prediction when it is clearly no longer the case.

Loads of BTC price analysts that predicted triple digit price predictions by the end of 2021 engaged in this duplicitious move by kicking the can of their predictions down the road until 2030 to claim they were not wrong in 2021, when clearly they were. And if they’re wrong in 2030, they will merely kick the can of their predictions down the road until 2035. We must be smart enough to understand that predictions that cannot be judged within a 12-month to 18-month timeframe are not predictions, but marketing ploys designed to keep you beholden to an incorrect narrative. Even though the trend is still up for BTC prices right now and I don’t foresee any crash in price for the rest of this month, it is never wise to dismiss a contrarian investor’s perspective by twisting their words to fit your own outlook. Many, not all, but many investors unfortunately always just hear what they want to hear, even when I state very different outlooks than the ones they falsely interpret them to be. In the past, regarding certain assets that I thought would crash due to my research, when I’ve made statements like the preceding sentence, some people have responded by asking me why I’ve changed my mind about that asset, an invalid question in regard to the analysis provided.

Time frames provided for asset price predictions matter.

For instance, loads of research I conducted about likely probabilites of BTC price behavior at the end of last year led me to predict higher BTC prices in November capped at $45k, higher BTC prices in December capped at $50k and a pullback in prices to start this year. However, analysis is always dynamic and requires updating, as the data I use for such predictions changes daily and constanntly evolves. So, in my best estimate, I think BTC prices have a little further to run this month, but should be relegated to the $53k to $58k range. But my immediate term prediction (for only this month) does not invalidate my past issued opinions that the Western MIB complex still seeks to demolish BTC prices at some point in the future due to the opposition it provides to their CBDCs. And it is quite foolish to believe Western spot BTC ETFs will protect against the possibility of such an event as bankers have only used their creation of gold and silver GLD and SLV ETFs to push gold/silver prices lower, not higher.

It is quite obvious to me and likely to any analyst that analyzes movements in both gold/silver and BTC markets that the movement higher in BTC prices was used by the MIB complex to aid their execution of slamming gold/silver prices lower this week. Thus, one should be wary that much of the last couple months’ of BTC price rise was manufactured to suppress gold and silver prices. As I’ve illustrated multiple times in the past in this very newsletter, a direct inverse correlation between gold/silver and BTC prices sometimes manifests in an exact syncing, to the minute, of the start time a significant rise in BTC prices starts and a significant price dump in gold/silver prices occurs. And when this inverse correlation amounts to gold/silver prices lower and BTC prices higher, one must always be cautious about the negative BTC price effects that may result when gold/silver prices finally reach their bottoms and experience reversals.

Despite successful manipulation efforts of the MIB complex with gold/silver prices, including the one just executed during Chinese New Years, unlike the uneducated beliefs of many that don’t understand the mechanisms of the manipulation game, the MIB complex cannot crash gold all the way back down to $800 an ounce or take silver to $9 an ounce as they did during the 2008 financial crisis. Too many factors has changed about the manipulation game, including massive changes in how Eurasian nations view the USD, since then for the MIB cartel to ever pull off such a feat again moving forward. Thus, a floor in prices to their manipulation game exists, that after its achievement, forces the Military Industrial Banking complex to release their downward price suppression schemes against gold and silver, consequently creating strong upward price movements for gold and silver assets. In other words, enough positive pushback to the MIB gold/silver price suppression schemes have happened in Eurasian nations from 2008 until present day that has transformed the West price manipulation schemes to now abide by Newton’s Third Law of Motion - for every action, there is an equal and opposite reaction. For now, the interdynamics of the East’s push back against the West’s gold and silver price slams puts Newton’s Third Law of Motion into effect with gold/silver price behavior.

Thus, if gold breaks above $2,050 and silver above $23.50 in the coming weeks and stays there, the $2,100 and $24 to $25 levels will become inevitable and likely quickly come into play. Thereafter, if the MIB complex feels that higher BTC prices will no longer aid them in their price suppression schemes against gold and silver, then this very good two month run for BTC prices could end next month with a decline in BTC prices. Again, though I’m seeing possibilities of this happening, I’m not yet seeing strong possibilities of this happening imminently, so I’ll revisit this topic at month’s end or when this possibility becomes more imminent. But just know that 99% of BTC analysts will never make any BTC HODLer aware of any realistic downside probabilities just as many of the gold “journalists” in Asia predicted rising prices throughout Chinese New Years this past week because they have zero understanding of the mechanisms that actually set prices (outside of China).

Lastly, stay tuned next week because I feel the time to buy uranium mining stocks for a big upside move is closing in, as many of the mining stocks I track continued to fall in price throughout this past week (and if you don’t understand why I’m so positive on the future outlook of uranium mining stocks under circumstances in which their share prices have been relentlessly pushed down for about two and a half straight weeks now, just read my uranium article I published this past week). Have a blessed weekend everyone.

An Explanation of Why "What You See is What You Get" is a Non-Operational Principle in the Global Investment Industry