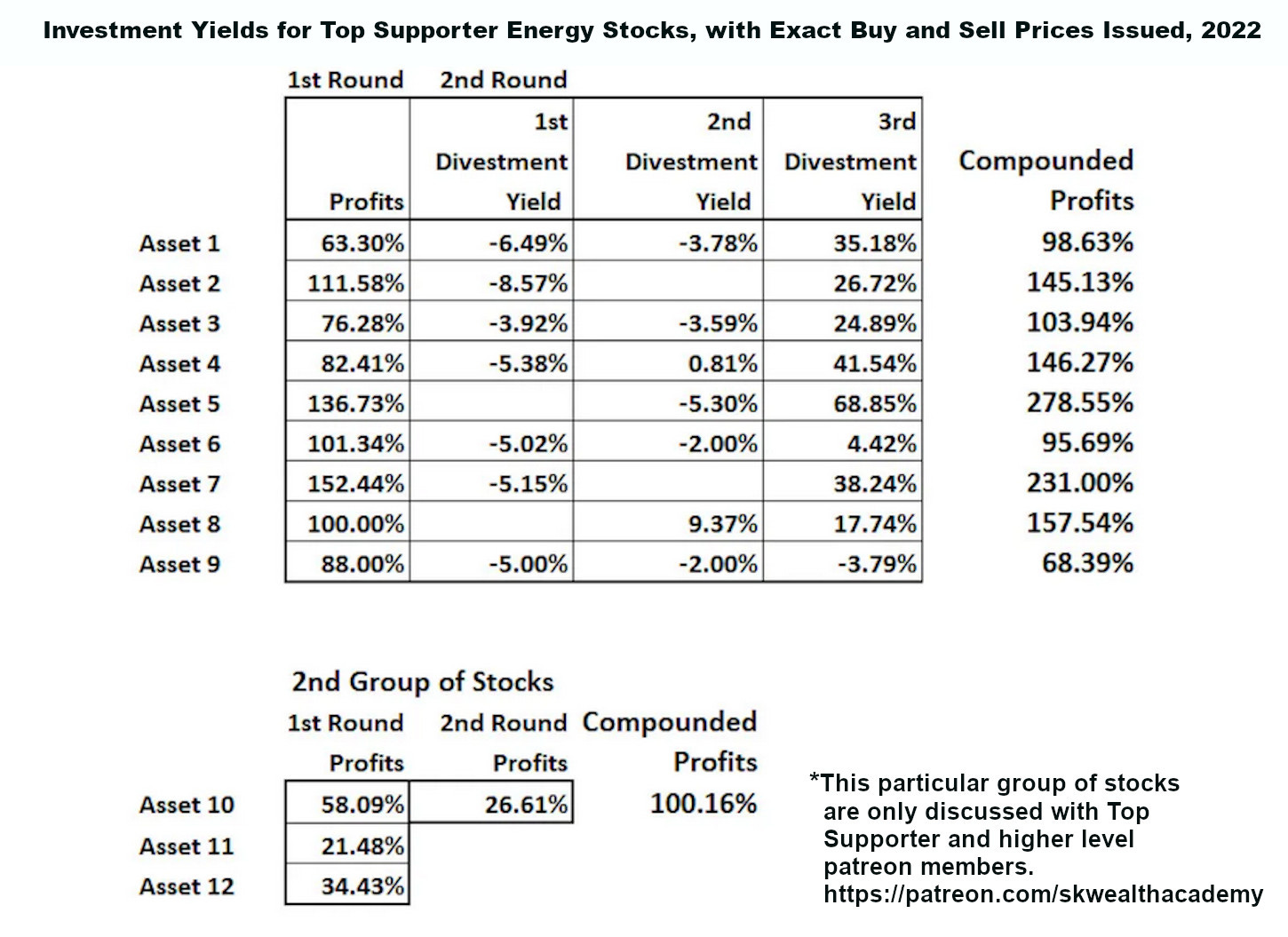

Above are the investment yields I’ve produced from the exact prices I’ve issued for my buys and sells for both precious metal (PM) mining stocks and a specific group of energy stocks. In the above charts, each number pertains to a single stock or asset, so for example, in the top chart, to the far left, the 14 numbers pertain to 14 different PM mining stocks, many of which were junior mining stocks. The identities of all stocks are fully disclosed on my patreon platform. I started issuing not only exact buy prices in my buy opinions but also exact sell prices in my sell opinions for all PM mining stocks at the start of this year in 2021. For energy stocks, I started doing this mid-year 2021 moving forward. Thus, the above yields are yields for all PM stocks and energy stocks for which I issued exact prices for both my buy and sell opinions, and as you can see, I have not excluded my opinions on any stocks that produced losses. However, the above yields only apply to the “Benefactor” and higher level memberships on my patreon platform because I do not provide opinions of exact prices to divest of stocks for the lower level memberships.

Furthermore, in the above, for the PM mining stocks, despite the flagship GDX Van Eck Gold Miners ETF being down (19.76%) ytd this year and other flagship gold mining companies like Newmont Mining and Kinross Gold having dropped even further, respectively by (27.2%) and (37.96% ytd), you can see that my overall year to date returns for my PM stock positions were significantly positive, with five stocks returning between +22.63% to +44.70% ytd returns. Thus, this is why I highly disagree with anyone that states mining stocks are a dead investment.

I don’t blame those that think it’s impossible to make money investing in PM mining stocks other than by perhaps opening up put options on them, especially given the chart of some of the most well known stocks in the sector like Kinross Gold. However, one of the major wrong beliefs about the PM mining stock sector is that you can just pick darts and throw them at a list and it doesn’t matter which stock the dart hits – the returns will all be similar. This is a massive fallacy. Though 95%+ of these stocks in this sector are duds, whether in a bull or bear market, there are a handful of stocks that are far superior to the others and the first step about investing successfully in the PM mining sector is identifying these stocks. In fact, I could present at least five PM stocks whose charts look exactly opposite of KGC as I’ve issued buys on these stocks earlier this year and will do so once again when it’s time to execute Round 3.

The only aspect that is “dead” about mining stocks is the antiquated buy and hold strategies applied to mining stocks that yield significant losses instead of significant gains. Though change is difficult for most people, and that includes investors, if one hopes to reap the easy 20% to 30% annual gains of the mid to late 1990s again, one will have to change and adapt.

Furthermore, of the 6 stocks that ytd have exhibited losses, I only led my patrons into one significant loss (14.36%) because it was a high-risk pure exploration play. Another of my discussed “buys” experienced a 5% loss simply due to the fact that it was a mining company based in Russia when NATO imposed anti-Russian sanctions were enforced. With the remaining four, I limited these losses to negligible losses of mostly 1% with a high of slightly over 4%. As well, even though it will take a 28.72% gain on the one exploration stock to recoup the losses of that former pick (for those that opted to buy that pick), I am actually quite optimistic of recouping all those losses and more during Round 3 of investing in PM stocks that will arrive later this year (and possibly extremely soon).

However, the two rounds of yields from my PM mining stock investment strategies in 2022 on my patreon platform are a perfect example, not only to exhibit the strategies I utilize that protect all capital against even moderate downside losses, but also to clearly illustrate why those that don’t exhibit patience AND learn about the macro factors of the assets in which they invest will never achieve any real investment successes. Without further ado, allow me to analyze and break down the yields for both rounds of the precious metal (PM) mining stocks first and then the yields for both rounds of the energy stocks. Because the important takeaway point is that not everyone that joins my Patreon platforms at the Benefactor or Top Supporter membership levels will achieve the same investment yields as illustrated in the above charts, even though I provide exact buying and selling prices in my opinions. If you don’t understand how this could be possible, then you definitely should read the below analyses.

Round 1 of PM Stock Investing

During the first round of the PM mining stocks that yielded enormous gains overall, you will see two columns of yields and then a final cumulative yield. The reason why there are two columns is the following: Initially, I issued buy opinions for a group of 10 PM mining stocks. I didn’t like the price action in these stocks within days after issuing my buy opinions, so I issued very tight sell prices for all ten stocks that ended up being triggered and consequently yielding either nominal gains or very small losses (except for stock #6). After waiting for several trading sessions to produce share prices with which I felt more comfortable with a longer, sustained hold, I issued buy opinions for the same 10 stocks plus four additional stocks for a total of 14 stocks. In the final column, you will find the final yield for Round 1 of PM stock investing on my patreon platform.

However, even with Round 1, I heard from some patrons that participated in Round 1, but because they never listened to any of my MUST LISTEN or MUST READ posts about the macro factors of PM mining stocks, did not achieve the massive positive yields of Round 1. Why? After divesting within a few days of my initial buy opinion, because they failed to learn about the macro factors of this investment class I had provided through various posts, they completely abandoned this asset class and never reinvested in it just a few days later, at which time I issued new and lower buy prices to purchase the same stocks and four additional ones.

Round 2 of PM Stock Investing

Clearly, from the jump, my caution in Round 2 should be apparent in the above chart. I only issued buy opinions (with buy prices) for barely more than 1/3 of the 18 stocks (7/18) for which I issued buy opinions in Round 1. Again, when the metrics I study to determine if we should remain vested or divest turned sour, I issued very tight exit prices and we divested quickly (the first column) with nearly all of our original capital intact. I thought there might be a chance for a rebound when the metrics I follow moved from negative to neutral, so I issued buy opinions again, this time on little more than half of the PM stocks I was tracking (10/18).

Unfortunately, these metrics then turned from neutral to pessimistic once again, and once it became clear to me that Round 2 was not going to work out, I quickly issued divestment prices for all 10 stocks to preserve most of our capital. I accomplished that task in my exit strategy for Round 2 sans one stock that was a high-risk exploration play in which I had explained at the time of issuing a buy opinion that losses could be wider on this stock (stock #15) than the others.

Why Those With Zero Patience Will Never Achieve Consistent Investment Success

Now, as we’re gearing up for Round 3, I proven with the real-world cumulative yields from Round 1 and Round 2 that I produced that achieving strong yields in an asset class (PM mining stocks) in a year in which the asset class has underperformed is not only possible, but actually achievable. Furthermore, even though my strategies by and large not only helped preserve the majority of gains from Round 1 but also helped preserve most capital devoted to Round 2, I can firmly state that there were some that lost complete interest in PM mining stocks because of the subdued minimal losses from Round 2 after the massive gains from Round 2. Again, this disinterest results from a combination of ignorance of the macro factors of this asset class as well as a complete lack of patience. And this disinterest will cause this minority group to completely miss out on what I expect to be massive gains from an upcoming Round 3 of investments in this same asset class.

Energy Stocks, Round 1

Round 1 was straight forward, as my timing when I issued buy opinions and prices for this group of stocks was near perfect and prices simply skyrocketed after the date at which I issued buy opinions until I issued sell opinions to lock in the enormous profits produced in Round 1. By the way, had I not issued sell opinions in Round 1 and directed my patrons to instead execute a buy and hold strategy, such a strategy would have resulted in a complete loss of the yields you observe in the above chart from Round 1. This is why all buy and hold investors are dinosaurs and why you take enormous profits that manifest even after just a few weeks’ time off the table.

Energy Stocks, Round 2: The Third Time is the Charm But Not For Those that Fail to Understand the Importance of Macroeconomic Factors

For Round 2, your eyes do not deceive you. The difficulty of the perfect timing I exhibited in Round 1 with this asset class is apparent in Round 2. And this round is the round in which investors with no understanding of macroeconomic factors would have exited at a loss instead of profits, for final enormous compounded profits from Rounds 1 and 2. In the first two columns of yields you observe above in the Round 2 chart, you will observe losses. This means my timing into entering these stocks was less than optimal, though my identification that these stocks would rise enormously in price again was not. However, in each of those instances, you will observe that I limited losses to 5%, and sometimes to less to 2%. Thus, by the time I issued the third buy opinions for these 10 energy stocks, we had preserved most of our capital to then reap massive gains on 8 of the 10 stocks, with many yields on the third time greater than 25%.

Note that when I speak of rounds, the investment period for each of these rounds is only a few weeks to a couple of months, whether for PM mining stocks or these energy stocks. Furthermore, I spent many posts on my Patreon platform explaining the importance of understanding the macro factors of this particular asset class and I stated, probably at least half a dozen times as we were being chased out of our positions during Round 2, to not be discouraged and to not sit on the sidelines for the third time I issued buy opinions. I was very confident I would turn a profit for everyone during this second round and I attributed the reasons to why I was being so persistent during this round, despite the fact that we had divested of them twice already, to the macro setup that I was confident would drive prices a lot higher soon.

And the average compounded gains I produced for my Top Supporter patreons for Rounds 1 and 2 was a whopping 142.5% on 10 energy stocks. However, even more shockingly, if one exercised a buy and hold strategy for the above 10 stocks, instead of having an average profit of 142.5%, for many of those stocks the profits would either be non-existent or in the single digits. (bigger font)

So, hopefully these real world examples of my investment strategies at work will prove two things to you, which I will outline in the conclusion of this article.

Critical Notification: The algorithms that determine whether or not my substack platform is seen by others is based upon likes, shares, and comments. Though nearly all my postings receive at least 1,000 reads, and many over 2,000, the likes, shares and comments always remain in the single digits. Those in charge of social media are making a very aggressive push now to censor all views that dissent from theirs by introducing legislation to “fence” the internet.

It is critical, to anyone concerned about the survival of truth online, that my platform grows as much as possible before 2023 as heavy internet censorship protocols are likely to be implemented by then. This does not have to be in the form of subscription growth but even growth here in free subscribers will help immensely as this provides a way for all of us to remain connected. There are many readers here that have not even signed up for a free subscription. Please do so today. In addition, the best way you can help truth survive, and especially platforms like this one flourish, is by liking, sharing and commenting on every post. Inaction caused by fear will only assure our mutual destruction and grant power to those most seeking to censor us.